Part 2 of the Law & Finance series

00:05 S1: Welcome to the Legal Learning Podcast. I’m Jolene, your host, and with the Legal Learning Center, I help pre-law students and law students with their legal journey. Today, we will chat with Nick about how to save money on student loans. A quick note I say “Stafford loans”, a lot in this conversation, that is the pre-term to Direct Loans. It means the same thing. So just keep that in mind. I used to work for Stafford loans and just can’t get that word out of my head, so it’s all the same thing, government loans. I will give you my top takeaways after this chat, but first, a word from our sponsor, Financially Free Aspiring Attorneys is a course with over $300,000 in money-saving tips for pre-law students and law students. If you wanna go to law school but don’t wanna pay for it, this course is right for you, visit legallearningcenter.com/financially-free for more information.

01:05 S2: I’m Nick. I’m part of an organization called Juno. Today we’re gonna be talking a little bit more about student loans, my background is in higher education, I used to run business development for Princeton Review.

01:25 S1: So what does Juno do exactly.

01:28 S2: So, you know, essentially, we’re the independent third party that sits on top of every major national lending agency to ensure that anybody looking to take out a loan or refinance their existing loans, gets lower interest rates than they would normally by themselves, we are a completely free resource, no obligations to take out these new loans or refinance, we just wanna give people the financial freedom that they’ve always desired.

01:55 S1: How do you guys do that?

01:57 S2: Yeah, so it’s a pretty cool process, so ultimately what we’ll be doing, we’ll collect people from all over the country nation-wide, we’ll put them in these different segments, then ultimately go present our case to the top lenders, and it’s at that time that we can negotiate group discounts, lower interest rates, and then ultimately in some instances, cash back values, and we run that competitive process once a year, typically towards the summer months, and really it kind of outlines when the typical loan period… majority of the time, people will take out in the new student loans twice a year before the start of each semester, where as refinancing is something that you can do year round I like to make the joke, you can do it on a Tuesday night before the fourth of July if you want…

02:46 S1: Wow, so even if you’re in the middle of school, you can refi your loans?

02:51 S2: So in the middle of school, it depends on the program ultimately that you’re a part of, most often than not, they’ll wanna see you have a job or things of that nature. More or less. To ensure that they know that they’re gonna get repaid.

03:06 S1: Got it. Okay, and so you mentioned bucket, so what are the different buckets that you guys have…

03:13 S2: Yeah, so it’s pretty unique. We started off in the MBA space, we opened it up to the undergraduate space, so we worked with all undergraduate students… I always like to say that we work with the 16, 17, 18-year-olds and their parents and grandparents, all the way to people in their 40s and 50s that are still looking to refinance their student loans, but we will put it out dependent on demographic range, we will put it out on dependent on a different factors, credit score range, not an actual credit score, because then we would not be a completely free resource medical, non-medical. So there’s a lot of different buckets ultimately that we pool out into, law has another significant ground as well, where we put people in a specific area, depending on your geographic location.

04:04 S1: Wow, okay, so if I’m a law student or a pending law student, then I would just sign up with you now, and you guys would put me with like people… So some other law students and with, again, like you were saying, maybe a geographic region and a general credit score and so forth, and then based on that, you guys would be able to potentially get me a certain rate…

04:26 S2: Exactly, that’s exactly right. So you’re comming in, it’s not necessarily just one or two people. Ultimately, they’re coming with thousands of other people nationwide that are in the same similar or same kind of boat as you. So I always like to give the example. You’re not alone if you’re coming in as a doctor looking to refinance, because we have many others that are coming in too… Looking for the same thing.

04:49 S1: Okay, so then what exactly is the benefit of being put into this bucket.

04:53 S2: So you get more negotiating power, ultimately, if you’re a one-off, go off and take out your student loan or refinance by yourself, more often than not these lenders out there, they have the ability to choose their own rates, they can do things like origination fees, there’s a plethora, different things that they have control over, that we wouldn’t be able to necessarily control ourselves, but coming in with the thousands of other people ultimately that come through our process, they have to dictate what we set as a precedent, the underwriting criteria is very strict for some of these lenders as well and the organization, so ultimately that’s the primary goal of what we’re trying to do, so creating a free profile in Juno, ultimately, you get directed to a particular link at a point in time, and that would be the transfer, the bucket you would fall under for the lender application on their end, and ultimately the process is pretty easy from there with a discount and priority applied.

05:58 S1: Okay, so you said no obligation, so I sign up with Juno and you guys put me in my bucket, you tell me what my rate offer is gonna be, and then I can just say, No, I’d rather do my own thing.

06:11 S2: Yeah, we’ve had… We’ve had some unique cases out there, some people say, You know I need to borrow $100,000 in the student loan, and then tomorrow they use a scratch-off ticket and they win the lottery, and they no longer need anything.

06:39 S1: Got it. That’s a much nicer scenario, I was thinking Maybe somebody… I inherited some money and then I thought, Well, that somebody has to die, so at least your lottery is a nicer scenario for them. Okay. Yeah, but yeah, most people they do need those loans ultimately, so… Okay, now, so is there a certain time of year, a certain month that would be best for people to sign up?

07:01 S2: It really depends on what you’re looking to do. As I was referring to a little bit earlier, people taking out new student loans typically starts around late April, goes all the way through the summer until about the first two weeks of September, and then it happens again very briefly for a couple of months in the winter months, typically November, December, and January when people are getting geared up for both the fall and the spring semesters, refinancing could happen year-round, so ultimately you can refinance years down the line, you can refine this as soon as you graduate and have a full-time job. We have all different types of people that enter our process some that will wanna be really aggressive and pay off all their student loans, and then others that feel comfortable with spreading out over a number of years, so it’s dependent on the person.

07:57 S1: So they can also pick the length of the loan as well, so let’s see if you… So you sign up with, you know, you fill out the form that tells you guys a little bit about myself and my situation, so you know the bucket, and then when it’s an appropriate time, you guys are negotiating loans, giving me the rates, and then how do I… Compare it to maybe some other offer I might receive, you guys have a way that I can accurately compare…

08:27 S2: Ultimately, you can go and shop as many places as possible, we can actually advise people to do so, so if they’re gonna get a particular rate through the lender that we selected, we can actually say, Hey, you know what, go out, check out what’s in the marketplace, see what else you can ultimately get working underwriting criteria, typically it looks like more often than not they’ll come back and realize, Hey, you know what, Juno has the best interest rate for me, I was able to negotiate all the underwriting criteria and the terms… I feel comfortable at this point to doing any variable, it’s really what the personal preference is, ultimately people realize the people, the organizations more or less that we work with are the same national lending agencies or organizations that I would work with. They did is a quick proof research.

09:15 S1: Okay, and I know it can be a little overwhelming with all the origination fees and the variable rate and then the flat rates and the different offers, is there either someone at Juno or some kind of way that maybe there’s an online calculator somewhere in the internet that helps you input all the numbers, so you can see over the life of the loan, if you get a better interest rate versus I can get a better origination rate or something like that… How that would play out?

09:47 S2: Yeah, so we actually negotiate in our underwriting criteria, no origination fees or anything along those lines, no application fee either, which is a huge cost savings, we do have student loan calculators that you can go and check it out, financial aid trackers, so if you get into a particular program, you could actually compare where everybody else did in terms of our financial aid packages at universities, these are all real-time data points that we get from a consumer base.

10:19 S1: So you guys actually have a calculator on your website. Okay.

10:24 S2: We have a few different resources that are available to students on there, also including scholarships, so we scour the internet for all of the potential scholarship opportunities that there are… As inclusive as possible. So what we’ve noticed is that there’s a lot of broken links, there’s a lot of people who qualify for particular scholarships, so we spend the time putting all of that together, we made it all available as a free resource,

10:55 S1: Wow, okay, so I will make sure to link up the calculator link and the scholarship link… That’s amazing. Yeah, I mean a loan and a scholarship in the same spot… That sounds great to me. Yes, yeah, if you can’t totally avoid the loans, then great, you’ve got some help here, and then on top of that, you even have help avoiding loans… That’s great. Okay, so let’s talk about the refi a little bit. You said that as soon as you get a job, you can refi, and so how often should you reapply or is there no rule I have at work after you graduate?

11:35 S2: So there’s really no rules. I’ve worked with folks that have refinance several times, and then others that are just gonna refinance once and they’re just gonna call it the end of the day, more or less, it’s about getting a lower interest rate, getting down that monthly, big payment, ’cause ultimately that’s how most people will figure out their finances, so there’s no rule regulations working with you now as well, we can help you refinance. It’s really at the discretion of what somebody’s going through ultimately, the refinance process is pretty simple, like I said, ultimately, they’d ask you some more and get questions when you get to our lender, and then you can choose to say, No, I’m gonna refi it. Or, I can do the one and only time that I would do it, and then we’ve been able to negotiate all the underwriting criteria for you, you have the choice, I wanna be really aggressive and refinance, I’m gonna pay it off in five years, or I’m in this for the long haul, I’m gonna spread it out over the course of another… Few more years.

12:41 S1: Okay, now, when they sign up with Juno, do they have to re-sign up every time they wanna retire? How does that work?

12:49 S2: So basically, they can create multiple profiles with us, typically on the new student loan side of things, people will do this every single year, and it’s kind of a reoccurring thing for refinancing, again, it’s completely up to you. Any point in time you can refinance, if you’re gonna re-finance multiple times, we advise you to call in, see if it’s something that’s gonna be worth while, if it’s gonna make that much of a difference ultimately… So it really depends on the situation.

13:21 S1: Okay, so same thing for students then, if they’re in the middle of their education, they should just come back every time they need a loan to just double check in and see what you can do for them.

13:31 S2: Yeah, absolutely, we advise as many profiles as possible, and hopefully one of those profiles will wind up working with… One of the deals are offers that we’re able to share for them.

13:43 S1: Okay, and how does… Because these loans are all private loans, right.

13:48 S2: Yes, they are all private type loans.

13:51 S1: Okay, so how does that work with the Stafford Loans in comparison, do you guys offer deals that are comparable to the Stafford loans?

13:59 S2: Yeah, so it really depends on what you’re ultimately looking to do more often not especially… So we’ll start at the undergraduate education, the undergraduate education, more often I’ll Tell folks, Hey, go take out the student loan to the federal government first and foremost, typically have the lower interest rates, then they’ll hit their federal cap and it’s at that point in time that our organization, Juno can come in and help fill out the rest of that gap, so we’re an alternative for an undergraduate market to what the parent PLUS loan to be, we’re gonna have a comparable, if not better rates than what they would see it with a kind of a rate, when it comes to graduate schools, law programs, medical dental, different programs, MBA like myself, privatized student loans are more common than not, so seeing what’s the best fit for you ultimately, and then again, you have the ability to say Thanks, but no thanks, or I found some money. Government loans should be the primary for undergraduates moving forward before anything else,

15:35 S1: Okay, yeah, I saw on your website that there were a lot of reviews and several of them mentioned that they got a better deal through you guys then they could get on the Stafford loans, so that sounds like it was probably a graduate type of student, is that… Correct.

15:53 S2: Yeah, but that’s where we got our start in graduate school, predominantly, and then we’ve expanded and so many people have ultimately utilized the resources … Its been fantastic.

16:05 S1: Yeah, no, it’s really impressive that you can get a better rate than the federal government will give you… I think most students just rely on the federal government’s gonna take care of us, so that they should have the best deal, so… Yeah, so it’s a little scary, but it’s good to know. There is something else out there that’s better. Yeah, I just need to make sure everyone knows that. I saw it looks like maybe a pilot program that you guys are starting for just graduate students where you’re taking information from them and trying to compare because the website saying that not everyone’s offered a same financial aid package, even though they might be very similar students or applicants. And so right now, it looks like that’s just for grad students. Is that right?

16:55 S2: Yeah, just for grad students at this point in time, there’s a lot of common misconceptions out there. And there’s a lot of misinformation out there. Ultimately, if you get an initial financial package, you can appeal that they’re not gonna rescind your acceptance, ultimately, if you’re gonna be doing that, so that’s a little tip and trick that ultimately a lot of people do not realize, they just think, Okay, this is my financial aid package, I either got a to school A or school B, and that’s not necessarily it, if You have a desire to go to school, like you can write a full application process and say, Hey, you know what, Longshot I need something on financial aid, is there anything that I could possibly do? Explain your situation and full… And then ultimately they make that decision, but they can’t rescind any of your acceptance or anything along those lines.

17:45 S1: Wow, that’s really impressive. Now, do you have any plans to later expand this experiment to the law community?

17:55 S2: Yeah, absolutely, we have a lot of law resources right now, it’s one of the more heavy hitting groups ultimately that we’re working with. So we’re able to help out as many people as possible.

18:26 S1: And just for any law students or pre-law students who are listening and don’t know this yet, ’cause I certainly did not know this in advance, your student loans only last until May unless you budget really well, and so when you hit time to take the bar exam, you have no money to live off of… The bar’s not until basically around August 1st or during covid later, and so you’re not working, you’re just studying, and you have to pay for the Bar Review course, you have to pay for the bar exam, you have to pay the rent and all that. So it’s… You need money, and so people end up taking an extra 10 grand or… I don’t even know what they’re up to these days. I don’t even wanna know, just to live. And so there’s this extra, you think you done, and then they say surprise you have another loan to take out if you wanna survive the next few months, and that is always a private loan, the government doesn’t cover that. Yeah. Okay, so that’s great. Now, I saw you also offer something for international students… Do you wanna talk a little bit about that?

19:38 S2: Yeah, absolutely, we… Especially we’re based out of Boston, Massachusetts, and we have a pretty large international student population that goes to the plethora of universities that we have in our own backyard, ultimately, we noticed that there were international students that were paying for international student health insurance Sometimes $5000 for the entire year, so we were actually able to negotiate better benefits with an organization that’s approved by the universities and significantly lower sometimes as low as $1500 a year.

20:26 S1: So yeah, so international students, if you wanna save more than half on your health insurance… That’s just great. I definitely know a lot of international students, a lot of them are in New York, but California also has a lot. And a lot of my pre-law students are international and looking to come to the US, and so it’s really… That’s a huge savings. They pay so much to come here and to get their education here, and just they pay so much more for everything, so then this is really a great service. I was really excited when I saw that because Yeah, if you’re an international student. Check that out. Yeah, this is great. Do you guys have any other plans for expansion? Seems like, I feel like you covered everything, but clearly not if you’re going into health insurance.

21:24 S2: So we’re always gonna be constantly looking to expand basically our primary goals, if we see something out in the market place where people are being taken advantage of, it’s costing them money anything along those lines, we’re gonna try and find them the best as savings, so ultimately, we have a few ideas that have been bounced around, nothing set in stone just yet, but definitely stay tuned and over the next couple of months will be certainly launch something in the right direction and open up more people that we’ve ever… Could have imagined.

21:53 S1: We’ll probably have to have you back on

21:56 S2: as many times that you like…

21:58 S1: Yeah, that sounds great. Okay, I’m excited because everything so far is just so helpful and so I’m excited to see what else you guys are up to, but… Okay, so if students wanted to… I know we have a link, actually that connects Legal Learning Center with Juno, so that one I will link up. That is one joinjuno.com/p/legallearningcenter, but is there anywhere else they can reach you guys on social media, that kind of thing…

22:31 S2: Yeah, Ultimately, they can reach out on Instagram, Facebook, TikTok, I believe. Now, that’s much different from when I first started, so any time that we’re available, please, you can go right on our website, joinjuno.com, you can give us a call, we can talk to you there. I’m also happy to give out my personal information as well, so you can call me at any point in time or something, you know is as well as we were here for, as many people as we can help out as possible is great Jolene is a great resource, ultimately to work through as well, so feel free to check out that landing page that’s gonna have all the details, the same exact thing, which you see on the website.

23:20 S1: Right, thank you so much, Nick, if you’ve been listening to the podcast, you know that Juno is one of our sponsors. And now you know why, the link that I mentioned earlier, joinjuno.com/p/legallearningcenter will get you to all the scholarships, there’s a PDF for law students, the calculator, their reviews, you can see the benefits of other students have received from them, there’s a bunch of pull down menus, go through all of them.

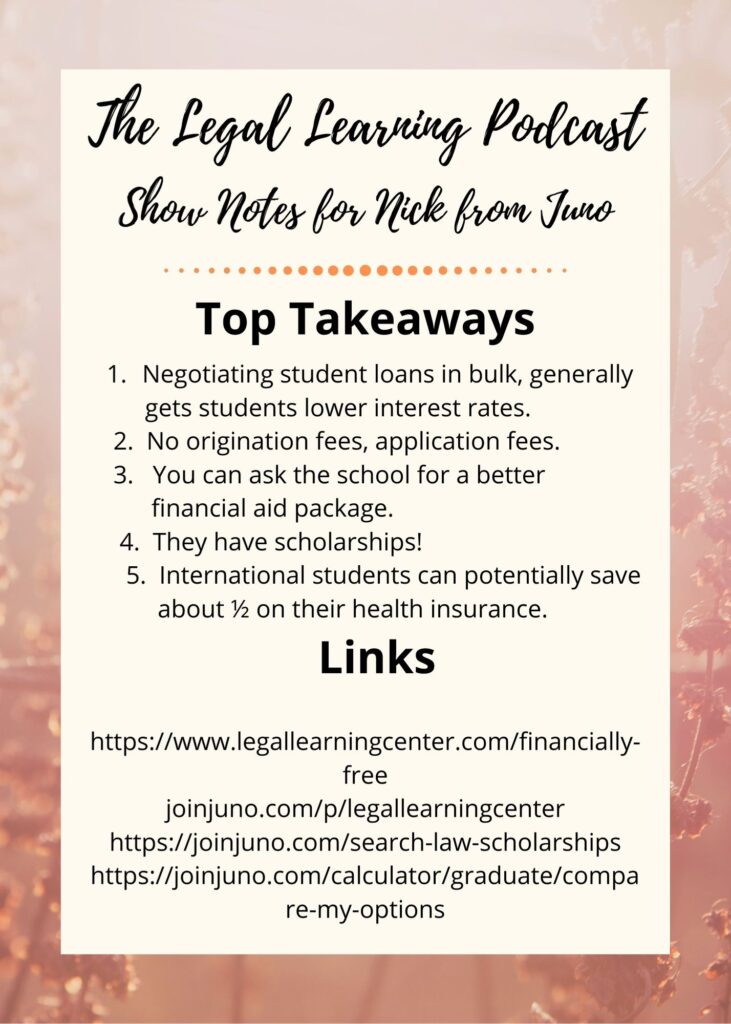

Let’s get into my top takeaways. First, Juno negotiates student loans in bulk, whether you’re doing a refi or original loan, and that can save you thousands… It’s just like going to Costco. When you buy in bulk, you save, they also do everything at no cost to the student, no origination fees, no sign-up fees, everything is free to the student with no obligation. Tip number two, they mentioned that you can compare your financial aid package to other students, and you can even just ask your school for more financial aid, they can’t reject you because you ask. Number three, they have their own scholarships that they find are helpful for students, so look out for those. 24:37 S1: Okay, that’s it for this episode. Be sure to check in next week when we talk to David, David is an attorney who runs creditmonkey.pro, we discuss credit loans and all kinds of different finance issues, and if you learned something today, please leave a review like comment, subscribe, share, so that more people can be exposed to this podcast and benefit from it as well. Thanks.

For more on our Law & Finance series visit http://legallearningcenter.com/tehfinancialcoaching to hear last week’s episode and stay tuned for next week when we chat with David Johnson of CreditMoney.pro. http://legallearningcenter.com/creditmonkeypro