Speaker 1 (00:00):

Welcome to the Legal Learning Podcast. I’m your host Jolene. And with the Legal Learning Center, I help prospective law students save $300,000 on law school.

Speaker 1 (00:12):

To receive three money-saving strategies today. Visit legallearningcenter.com/money. Today, we are joined by Rho Thomas who has paid off about $450,000 in debt in just four and a half years. We are going to talk about how that’s possible and how you can make that happen for yourself.

Speaker 2 (00:36):

Hello. Hello everyone. And thank you so much for having me. My name is Rho Thomas. I am a lawyer and a financial coach for lawyers and I also host a podcast called Wealthyesque where I help lawyers learn how to regain control of their time, build wealth and live the lives of freedom and choice they deserve.

Speaker 1 (00:55):

That sounds awesome. Okay, so let’s go back. What year did you graduate from law school?

Speaker 2 (01:03):

I graduated from law school in 2014.

Speaker 1 (01:06):

Okay. And what’s your family situation now? You’re married. What does your husband do?

Speaker 2 (01:11):

Yes, I’m married. My husband is a family medicine physician and we’ve got two little boys ages four and two.

Speaker 1 (01:20):

All right. So that’s a lot of student loans potentially there.

Speaker 2 (01:25):

Yes. So my story, so my husband has his own mortgage. I say all the time. It’s my husband’s student loans were actually larger than our mortgage. About four and a half years ago, we added up all of our debt and we were over $670,000 in debt. I had a little over a hundred thousand. My husband had almost 350 and we had a mortgage that was like 200 and then maybe about 10,000 on a car loan. And so all of those numbers, like, you know, above and beyond and whatever, all add up to 670,000. So that’s where we were.

Speaker 1 (02:05):

You know, it’s funny. Cause when you go into higher education, you know, you’re taking out loans, but you don’t really think about it in terms of these huge numbers where, Hey, if I marry a doctor, if I marry another lawyer, it could be a huge number very quickly. And again, if you buy a home, it sounds like, where do you in general, what, where do you live?

Speaker 2:

We’re in Atlanta.

Speaker 1:

Okay. Cause I’m like, that’s not an LA home. I mean that’s yeah, it could be a lot higher you’re in LA. Okay. So what happened to get you into this financial world?

Speaker 2 (02:41):

So my journey into personal finance actually began before law school, even. I was in college and in the summers, I worked at the mall. I worked at Express and I would go to the food court during my lunch break. And you know, like every day I’m getting, you know, $5 meal here, dollar meal there. And one of my friends from back home was really into personal finance and he brought to my attention that going to the food court every day on my lunch break, adds up to a lot of money over the course of the month. I had not thought about the like cumulative effect of that. It was like, oh, it’s only $5. It’s only $10. And like when he showed me that it was like, oh wow. And so I started researching more about money and I learned all the things that you’re supposed to do.

Speaker 2 (03:28):

You know, making sure that I am not spending all of the things. Cause the thing about me, I was eating all my money, right? Like the food court run that go into Chick-fil-A going out to eat on the weekends, you know, all of that. And I would easily spend the little money that I made at my work study job or at my summer job easily. So I started learning about finance there, but it wasn’t until four and a half years ago, my husband and I had our first son, the four year old that I mentioned. And we were thinking about how we wanted to raise our kids. We’re thinking about the kinds of lives that we wanted to live at that point. My husband was a resident. I was a second year associate going into my third year. And I’m very type A, like I am the stereotypical lawyer, like so much so that I went to my team leader like, Hey, so I want to be a partner.

Speaker 2 (04:18):

I was a first year, mind you, partner. So tell me about that. Like what, what do I need to do? Right. So I was doing all the things I was billing above and beyond our billable hour requirement, you know, doing all of that. And when I had my son and I’m thinking about, you know, how I want it to raise him and how I had always envisioned being as a mother, the two didn’t really mesh, right. It didn’t really work. I’m like, okay, maybe I don’t want to go back and do what I’ve been doing. How can I shift gears a little bit? How can I change things? And that’s what prompted my husband and I to like look into our money, see where we were, see if we could make some changes. We saw $670,000. So we were not making changes at that point.

Speaker 2 (05:04):

And that from did us to start researching we learned about, you know, paying off debt quickly. We found so many different resources out there. We came across Dave Ramsey, who you, you and I have spoken about came across lots of people who were blogging about their own experiences with debt. And so it was like, okay, we’re seeing people who are actually doing this, seeing people paying off relatively large amounts of debt in small time periods. But the thing that was missing and part of why I started sharing our story was a lot of times those debt loads were a lot smaller than what we were dealing with. You know, it’s like, oh, I paid off $30,000 in a year. And I’m like, oh, I wish I had $30,000. And so that’s how we got to this point where here I am telling everyone about are over half a million dollars of debt.

Speaker 1 (05:55):

That is a lot of debt. And just the number alone I think would make most people freeze. Okay. So most of that was your husband’s loans followed by the mortgage followed by your loans?

Speaker 2:

Yep.

Speaker 1:

Okay. So first of all, what year did he start actually working and making money?

Speaker 2 (06:18):

He graduated med school in 2015. And so he was a resident for the next three years after that until 2018. And then he became an attending.

Speaker 1 (06:28):

Okay. All right. So the first couple of years that you were working on this debt was just primarily your income then, right?

Speaker 2:

Yeah.

Speaker 1:

Okay. So how did you do it while it was just you?

Speaker 2:

Okay. So the first thing was getting on a budget because we did not have one of those. One thing that I think a lot of people don’t think about when you’re coming out of law school, coming out of med school, I really like coming out of school period and like beginning work. Like you don’t realize how far your money doesn’t go.

That’s not the most articulate way to say that. But you know, like think like, oh my gosh, we’re making all this money because you’re not used to making money, but when you’re not paying attention to it, it can go really quickly. And so when you’ve got, like, I came out and went straight into big law, I’ve been in big law my entire career. And when you’ve got that money coming in and all of your, you know, basics are covered, it’s very easy to just let the rest of that slip through your fingers.

Speaker 2 (07:28):

And I told you, eating all of my money. So we were going to all the restaurants and doing all the things right. And just not paying attention. And we were doing the things that you’re supposed to do traditionally. So we saved a little bit, we were maxing our 401ks. We were paying off our credit cards in full, like all of that kind of stuff. But we were not paying attention at all to the debt. And we had the like autopay going, we were paying our minimum and talking about my loan specifically. So I had about 110 or so coming out.

I don’t remember the exact amount because like I said, I wasn’t paying attention, but I was paying almost a thousand dollars. My monthly payment was almost a thousand dollars a month and two years in, at this point when we had my son I’m looking and the balance is at 104,000 and I’m like, wait a minute. Something is not adding up here. And I think that’s something that we don’t think about too, right. That interest in how expensive the interest can be. And so when we actually put in that plan, like set forth our plan after seeing other people who were making things work, who were thinking about money completely differently and looking at paying off debt quickly and how they can, you know, learn to invest. And all of that, we got on our budget. We started putting extra on our debt and we have continued going from there.

Speaker 1 (08:54):

Yeah. I think that’s the thing is that, unless you’re really looking at that bill and of course they encourage you to put it on auto pay. So you’re not looking at that bill, but unless you look at it, it really does go up. And by the time a lot of us are looking at it, it really hasn’t moved very far from our original loan amount. And again, yet, most of us probably have tried to not know how much our total loan amount was. So we don’t know how far down has it gone down 2000, 10,000. I don’t know, but it’s still close to where you swear it was originally. So what’s going on and it’s that interest and it’s, unless you do something about it, you’re going to be in that same kind of not moving very much boat for a really long time.

Speaker 2 (09:39):

I agree. Completely agree.

Speaker 1 (09:41):

Okay. So how much were you able to pay down while he was still a student or while he was a resident?

Speaker 2 (09:47):

So while he was a resident like that very first year, we paid off about 50,000 of it.

Speaker 1 (09:53):

Wow. That’s really impressive. I mean, honestly, almost regardless of income, I mean, I know you said you were making good money, but seriously, even when you’re making good money, that’s a lot of money to pay down.

Speaker 2:

Well, thank you.

Speaker 1:

I, this, and so encouraging because I have had students come to me, I’ve had interns in the past, you know, when I was working corporate ask, what can I do? I, you know, I have one more year of school. What can I do? And it’s like, oh my gosh, I’m so impressed. You’re even asking at this point, you know, because yeah, it’s, you have to be intentional. And that’s, I think where most people put their money is cars and food, you know, it’s you, first of all, you don’t have to buy a nice car for a lot of your money to go to a car. And then yeah, the food, it just going out with friends, going out for drinks, you know, a couple of times a week. And then, you know, your casual lunches and a quick Starbucks in the morning. I mean, all of a sudden, wait a minute, it’s $30 at least a day. You know, it’s it’s, it goes fast.

Speaker 2 (10:50):

I completely agree. And you know, one thing that I always tell students coming out is look at how much you’re spending now as a student, you’ll probably live in a pretty good life right now, not to say that you have to continue living completely like a law student, you know, do a little bit more. Right. But don’t let that spending get so out of control. And it’s really easy for it to just balloon your first year out because you’re finally making money. Especially like I went straight through kindergarten to law school. It’s like, I didn’t make money for like the whole first twenty-five years of my life. And then all of a sudden I’m making money. It’s like, yeah, I’m rich. You know? And I was not, I was literally the opposite of rich. I had a negative $342,000 net worth.

Speaker 1 (11:37):

Yeah. It’s amazing. And I think that we get caught up in, well, everyone else is buying a new car and I need to show off and, and whatever. Even if you don’t quite feel like you have to show off, you still just feel like you have to maintain a certain professional level. And it’s interesting because you never know what’s going on behind the scenes. One of my friends from law school, she lived at home. A lot of us did during law school. And she continued to live at home for like, I think the first five years, I think she actually made partner before she actually moved out. So, I mean, you don’t have to live in a nice apartment. You don’t have to own anything. You know, she had, I mean, she did buy the car, but that’s it, you know, it was, you know, you don’t have to do all the things. Yeah. You can live on that lower budget and just get that knocked out.

Speaker 2 (12:27):

Yeah. And I think to that point of your friend and what she chose to do, I always encourage my clients and students and everyone to pay attention to what is important to you? I think so often we do come out and think that we need to live the lawyer lifestyle and I’ve got to be in the fancy apartment that’s, you know, right. Downtown and get the nice car and go to all the hottest restaurants and all of that. But like, what do you care about, right?

Because like, for me, I don’t care so much about the cars. I like fashion. That was my thing. That is my thing, you know? So I will spend on that, but I don’t care so much about the car. I don’t care about living in the fancy place. Right. Downtown or right across the street from my, from that there’s this condo that’s really close by where my firm is, where a lot of people will live or like in that area. But a lot of times the places that are right there in the heart of the city are going to be way more expensive than something that’s a little bit further out. So just paying attention to what you care about, what you value spend on what you care about, don’t spend on the rest, like your friend who spent on the car that she wanted, but then saved money by living at home. I think that was a great decision on her part.

Speaker 1 (13:34):

Yeah. It was really impressive. It was. I kept wondering, when are you going to move out? And then when she hit partner, I said, seriously, when are you going to move out? Like, I want to ask, but I’m kind of wondering here. So yeah. But you know, I mean, I can’t even imagine the amount she saved and I know she did advance payments on her loans and you know, so, and then she bought, so, I mean, yeah, she did a great job, so yeah, unlike a lot of us. So, you know, we spend, and then suddenly it’s not till something kind of starts to fall apart or yeah, we have kids and we realized, wait a minute, I need to start saving for their college and my retirement and pay bills. And I want to buy a house. And there’s just all these things that are now floating in the air and hovering at our future.

Speaker 2 (14:18):

Yeah. And to your point, it does not ever get easier, right? Like no people are like, oh, I don’t have time to do that. Or I don’t have the capacity to do that. And as you move through life, there are other expenses that come up that are going to eat into your capacity to handle the student loan debt, if that’s what you want to do. Right. So why not do it now? Especially if you’re just graduating, you’re used to living on this lower amount, keep living on a lower amount and tackle the debt. And then you’ve got so much money for like, when we paid my student loans off, we got a thousand extra a month that was just available to us. Wow. Granted, we decided to roll it into the next step, but right. But it was a thousand dollars more.

Speaker 1 (15:01):

Yeah. It’s so nice to know you have that thousand dollars. And again, if there was an emergency, you know, you’ve got that thousand dollars a month that you can just pull from and you don’t have that commitment. If everything went south, for whatever reason, right. You suddenly, I don’t know how to move out of state for some crazy reason. I don’t know. COVID right. Everybody’s been moving. So, I mean, there’s been a lot of things. I mean, if you look at the last year or so that people probably made a lot of decisions, they weren’t planning to make. I know a lot of students had to live at home and had to go to school in a different time zone. I mean, there’s all kinds of chaos. You can’t predict the future and yeah, the sooner you pay off debt, the more secure that future will be. The more options you’ll have in life for all the things that might happen.

Speaker 2 (15:49):

I Think that’s what it’s all about. You know, having that flexibility, something that I tell students as well is when you prepare on the front end, then you don’t have to worry about being stuck down the line. Because you know, a lot of times, I don’t know what the current statistic is, but at one point it was like students are changing jobs. I guess lawyers are changing jobs three years in four years in, right. And if you get into a job and you start spending at the level that that income is right, you start spending right up to the new income and you want to make changes or you want to go do something that maybe pays a little bit less than you’re not in a position to do that. Or you are less able to do it. I want to say that you’re not in a position at all, but you’ll have to, you know, maneuver a little bit differently than if you do make those kinds of decisions upfront and plan for it ahead of time. And like you said, it just gives you that kind of flexibility and those options to make whatever changes you want to, you don’t have the golden handcuffs as we call it. Right. You’re not stuck in a place that you don’t want to be in because you can’t afford to leave.

Speaker 1 (16:55):

Yeah. It’s really bad. When, I mean, I’ve had jobs lie to me about what they’re like and what they stand for and all that kind of stuff. And so I went into it in the thought, oh my gosh, what happened here? And this is not at all what they were describing to me. And then you’re, you’re a little bit stuck, you know, you have to, and I remember at that job, I think I took a $20,000 pay cut to go into the industry I ended up staying in for 15 years because my friend was there. She was working reasonable hours, making good money. And even though I was trying a different field, it just wasn’t working. And I just was like, I just need to pay bills. So what do I need to do to get my foot in this door? And it was like, well, you need to take a $20,000 pay cut. And I was like, really, it’s not really necessary, but you know, that’s what I had to do. And to then go back up and yeah, if you’re not being careful, it’s, you may not be able to have that option. It’s really, you just don’t know. You really don’t know. So. Okay. So you guys started paying, I think it was January, 2017 is what I saw. Is that right?

Speaker 2:

Yes.

Speaker 1:

Okay. So that’s at this point about what four and a half years almost. Okay. And you’ve paid off how much,

Speaker 2 (18:13):

So I don’t know exactly how much we’ve paid off, but I’ll say we started at over 670 and we are currently at about 220.

Speaker 1:

Oh my gosh. Wow. That has to feel so good to say that,

Speaker 2:

It does. It does. So what we have left is about 190 on our mortgage, a little under 190 in our mortgage and then a little over 30 on my husband’s student loan.

Speaker 1 (18:38):

Okay. Wow. Okay. So I think that’s total payoff of about 450,000. Is that right?

Speaker 2:

Yes. Yes. And his student loans, which were the biggest thing are down to 30,000.

Speaker 1 (18:51):

Yes. Oh my gosh. And I remember like years ago, I thought we would never pay those things off because he was a resident. He had almost 350 when he graduated and we chose to do the income based repayment for his loans. And because of his resident salary, as compared to that student loan, the payment wasn’t even covering all of the interest. And so his loan grew to 370 something thousand before we actually started tackling it because we did the debt snowball where you pay your loans off from smallest to largest. My husband had consolidated his, but I didn’t. So I had like 14 different loans, right. The first one might’ve been like 1500 or 2000. And then the largest was like 30 something thousand. And so, you know, we got through all 14 of those and then my husband’s like $370,000 loan that it had grown to. So I remember like being like, oh my gosh, how are we ever going to do this? But you know, you just keep going. You just keep putting one foot in front of the other and you, you make it happen.

Speaker 1 (19:56):

Yeah. I think that when we look at these again, these big numbers, it does, it feels insurmountable, but you have to break it down in a way that makes sense for you. So, you know, if you’re paying, I don’t know, $2,000 a month towards something, okay. And you cut out, you know, $500 worth of food from your budget, then you’re putting in 2,500 into that, you know, loan. And then again, any time you come across a raise or whatever you’re putting in that extra, into that loan. So that you’re almost not even looking at that $370,000. It’s just more that what’s the monthly payment. We already figured out how to add a little to it. And then we’re just going to keep adding to it until all of a sudden yeah. We’re down to 30,000. Yeah.

Speaker 2 (20:39):

And I mean, one thing too, like my husband, when he was a resident took on a second job, he was moonlighting to bring in more income as well, which was very tough because imagine, you know, resident who’s like doing these overnight shifts and we’ve got a newborn at home and then he’s like going and doing this moonlighting thing. So he’d be gone like two weekends out of the month. But that was a sacrifice that we were willing to make so that we could get the ball rolling. And then it, wasn’t only about the debt because he also wanted to Moonlight to hone his skills and all of that before he graduated residency. But to have that extra income was really helpful too.

So, you know, I don’t think it’s all about cutting expenses. I think a lot of times we talk about, you’ve got to cut this and you can’t have that and don’t drink the lattes and you know, all that stuff. But you know, if there are ways for you to bring in more income, I sold things like my son got a lot of, you know, baby gear that he grew too quickly and we didn’t get to use some of it. Like we still had stuff with tags on it, stuff that was still in the packaging. And I sold those things, you know, all of that. And we put it towards our debt as well. So I think that you just got to create your plan. Yeah. And then move forward with your plan.

Speaker 1 (21:54):

It’s funny because you know, I’ve sold my children’s clothes, you know, we buy these nice winter coats and then, you know, I’m in LA. We use them a couple of times, you know? So that’s it, you need to have it when it’s cold, but really it’s rarely cold. So yeah. They outgrow them so I resell them. And it’s funny cause you can resell them, you know, in certain places for like a couple bucks, but then I’m like, oh no, I want to go on like Poshmark where I’ll get 10 bucks or whatever. And then you’re sitting here going, I’m a lawyer. Why am I doing this? But you know, it all goes towards that debt. You know, it, it goes towards that bill that you have. And so I’m, I’m definitely of the same mindset, but it’s funny because as a high paid attorney, I’m sitting here going, I’m worried about whether I get $2 or $10 for this jacket.

Speaker 1 (22:40):

So yes. But I do want to put that out there. You guys it’s okay. It’s okay to sell the old furniture or whatever to sell the baby clothes. Like, you know, it’s, I don’t know. I think sometimes we feel like we’re above that or like we shouldn’t be worried about these $2 or whatever it is because we make, you know, a hundred thousand or whatever it is. And it’s not the case, you know, it all adds up. And how desperately do you want to get out of debt so that you have the money to go on a trip whenever you want to go a trip or again, when you have kids, you never know if they’re going to be healthy. I mean, do you have extensive medical bills? Do you have to take care of your parents? Cause something happened to them. I mean, you just don’t know. And so it’s nice to know you have the money that you have the ability to do these things or pay for the entire family, not just your family, but your parents and so forth to go on a cruise or whatever, you know? Yeah. You can have that if you’re not drowning in debt.

Speaker 2 (23:37):

I will say like, as far as selling things, make it easy on yourself, right? Like the pickup place for me was always at my job. So I just brought the thing with me and now I’m here and I’m okay, here you are. You know? And they do the, whatever the exchange of the money. I don’t think it has to be like, I think a lot of times we think about it as like a daunting thing. It’s like this extra thing that we have to do. And it’s really not that big a deal. It’s really not, you know, to your point, it depends on how committed you are. Right.

And that’s not to say that everybody has to go and sell things. I just happen to have a child who was growing very quickly. And I had things that still have tags on them that I could get rid of. I didn’t want them. And so we could sell them and make some money off of it. But it depends on your commitment level and what you are willing to do. Right. If you’re not willing to do that, that’s fine. But what are you willing to do? And then do that and stick with it until you reach your goal.

Speaker 1 (24:33):

Yeah. It’s, it’s amazing. You talked about the lattes and the price difference when you really look at it between a Starbucks coffee and a Starbucks latte it’s a big difference. And I think you, you get into your little habits. You like, you’re a little drink, whatever it is, the mocha, I don’t know. But you get used to paying your price and it’s like, well, wait a minute. What if even again, yeah, once a week I go down to just a coffee or every day I go down to just the coffee, it’s a lot cheaper, you know, just all these little things that, yeah. What are you willing to sacrifice if you’re not willing to give up the latte? That’s okay. But like just what else.

Speaker 2 (25:09):

And just be mindful of what you truly care about. You know, I am not of the mind of like, don’t drink the latte and the avocado toast and all of that. I think if you like lattes, if you like avocado toast or whatever thing that, you know, the personal finance world is saying, we shouldn’t have get that thing. Right. But it’s what do you care about? Spend on that. And then what don’t you care about? Stop spending on that? Because I think especially in the legal profession, in the medical profession, in, you know, accounting in these professional fields, we get really caught up in looking the part, right? Like we get really caught up in like, oh, I’m a lawyer and I’m supposed to have this kind of car and I’m supposed to live in this kind of place. And I was supposed to wear these kinds of clothes.

Do you care about that? Like if you don’t care about that, then don’t spend on that. Right. It does not matter like what other people are doing because that is a recipe for being broke for not having money. I know so many people who, you know, have all the things and you know, they’re, they’re buying all the things, they got the car and they’ve got the house and they’ve got the, this, and they’re miserable in their job, but they can’t afford to leave because they’re spending the money on all this stuff. And I don’t know whether they care about it or not, but I’d be willing to bet that they don’t care about every single thing that they’re buying. We are just not taught to be intentional about our spending. We spend just because, and, oh, well now I got a raise. So I got to get a nicer car or a bigger house or whatever. And so I think to your point, be intentional, right? Look at what you’re willing to sacrifice. And for me, I’m going to sacrifice the things that I don’t care about that I’m spending on. And the things that I do I’ll keep spending on those.

Speaker 1 (26:52):

I think that’s such an important message to hear from someone who works in big law has always worked in big law. You know, who has a husband, who’s a doctor. So I mean, obviously again, you guys are bringing in the money and so to hear don’t buy all the stuff, you know, you don’t have to impress everybody. You know, I think a lot of times, again, we look at other people and say, well, okay, but you’re obviously not a successful attorney over you’re clearly you decided to go the nonprofit route or whatever, you know, whatever, little way that people want to look down on others.

And so it’s really good to hear this message from someone who is making the money and saying, I still have to work really hard and I still have to make choices. And yeah, my husband had to basically be working two jobs. That’s, it’s good to know that, you know, one, you can get so in debt and still get out in a reasonable amount of time and that two. Yeah. Even people who make good money should be really evaluating what their purchases are and, and be in touch also. Yeah. Okay. So tell us a little bit about, I know you said you help other attorneys. So just so everybody understands what exactly you do, what do you do?

Speaker 2 (28:01):

So I am a financial coach. I help people make those kinds of decisions about what they care about, what they don’t care about. We do a lot of like mindset work because most of the personal finance is really about our mindset. And it goes back to the conversation. We were just having about thinking that I should have these things because I’m a lawyer, I’ve got to buy this because I’m a lawyer or, you know, whatever that is, we get into some of that stuff. And like just reframe the way that we’re looking at our money and the way that we look at ourselves and what success looks like and what you really want. All of that. And then I also help people to come up with the plan for how they pay off their debts savings, some investments. I don’t give investment advice, but I can help people to figure out where they want to invest all of that.

Speaker 1 (28:50):

Okay. That’s great. That’s good to know. Cause you know, as we go through law school and start incurring that debt and then we start making money, it’s really good to have some advice and some, you know, somebody to hold our hand a little bit. So. Yeah. All right. Well, thank you so much for joining us today. I really appreciate your time.

Speaker 2 (29:08):

Well, thank you again for having me. It’s been such a fun conversation.

Speaker 1 (29:12):

I was having such a good time chatting with Rho that I forgot to ask her where we can find her so that you can follow her debt free journey and maybe make it a part of your journey. So she is on LinkedIn and on the internet as Rho Thomas rhothomas.com. She is on Instagram and Facebook and Twitter as I Am Rho Thomas. And she also has her own podcast, wealthyesque.

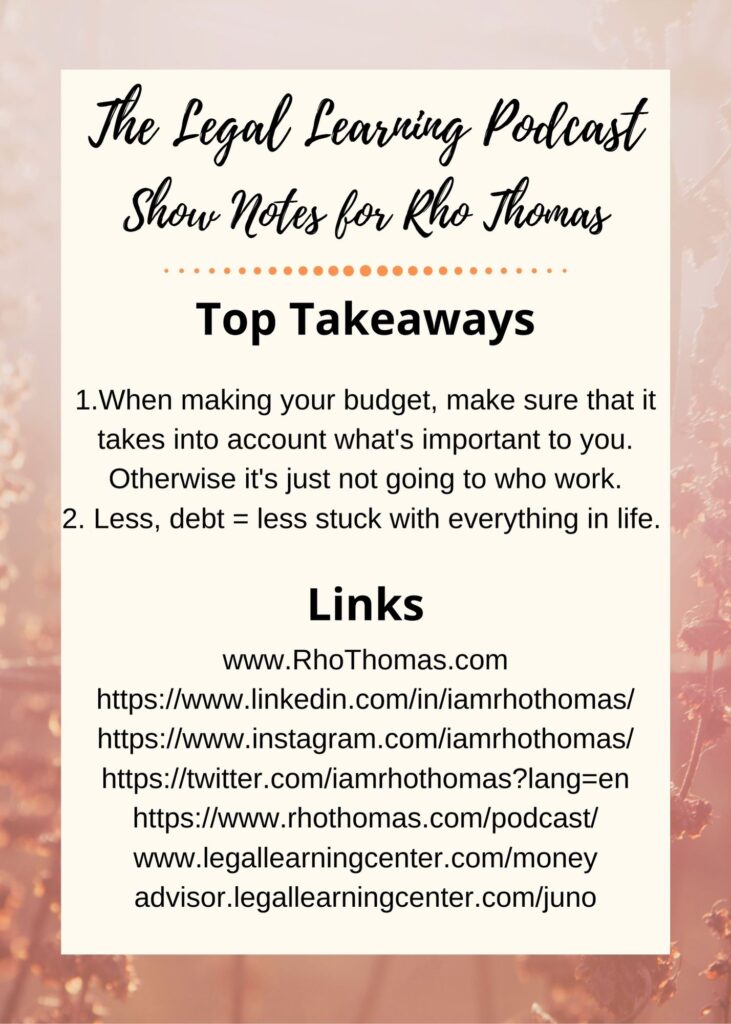

So check her out at all the different locations so that you can see how much she’s paying off. Before we get into my top takeaways, a quick word from our sponsor. Juno if you have to take out student loans, check in with Juno. First, Juno can often offer law students one to 2% lower interest rates than the federal government and with no origination fee and oftentimes cash back as well. Visit advisor.legal learning center.com/Juno. For more information, my top takeaways from this chat with Rho one, just when making your budget, make sure that it takes into account what’s important to you. Otherwise it’s just not going to who work.

Number two, less, debt equals less stuck with everything in life. That’s it. For this episode, all the tips and links will be in the show notes. A full transcript will be available@legallearningcenter.com/Rho that’s Rho. And if you enjoyed this episode, please leave a review. It helps the show help more people. Thanks.