Part 4 of the Law & Finance Series

0:00:01.2 S1: Welcome to the Legal Learning Podcast. I’m your host, Jolene. And with the Legal Learning Center, I help pre-law students and law students with their legal journey. Today’s guest is Jessica of Jessica Medina, financial consulting. She is a lawyer-turned financial coach, and so her experience gives her the unique ability to help her clients in the legal field. After our chat, I’ll give you my top takeaways, but first, a quick word from our sponsor, Financially Free Aspiring Attorneys is a course with over $300,000 in money saving tips. If you wanna go to law school, but you don’t wanna pay for it, visit legallearningcenter.com/financially-free. For more information on how you can avoid law loans.

0:00:55.5 S2: Hi there, thanks so much for having me on, Jolene. I am a former lawyer, turned accredited financial counselor, and I help other lawyers figure out their finances so they can pursue their true passions no matter the salary…

0:01:08.6 S1: Wow, I like the sound of that. No matter the salary. so what is a financial counselor?

0:01:18.2 S2: So as an accredited financial counselor, I’ve gone through a full curriculum to learn a lot of the facets of personal finance, so it’s not just my own personal finance journey that I bring to the table, so I am quite familiar with it, but… So it’s a certification program through the association of financial counselors and planning education, so they really have a large focus on making sure that you know how to work with people and not just money, and also that financial literacy is a really big pillar of whatever your practice is… And so that’s why I offer a lot of free trainings, it’s why I speak on personal finance topics, whenever I have an opportunity. I think that if people want to work with me, I would love to be able to help you with your personal situation, but I also want to make sure that people have the tools that they need to do this work on their own.

0:02:06.5 S1: Now, you went to law school, right? I did, yeah. Okay, and you practiced as an attorney…

0:02:13.2 S2: Oh yes, absolutely. I practiced for over 15 years here in the DC Metro area, and I switched out of law. Let’s see, I have… I have quite a law journey, but the last stop that I made was at the Securities and Exchange Commission, I was in the Division of Enforcement, that’s where I really got exposed to the financial industry, and that’s where I determined I no longer wanted to practice law, and in order to do that, there were some personal finance things that I needed to iron out in my own life to feel comfortable making that leap, and that’s when I really left the law to pursue financial counseling. Of course, working at the SEC, there was no way that I would be able to be a part of the financial industry that I was regulating, so I had to make a very clean break and I did that in 2018.

0:03:00.6 S1: So you actually have the full legal background, so when you’re helping lawyers and attorneys… You actually have been there.

0:03:07.8 S2: Oh yes. A lot of my clients, they hear my story, it resonates with them, I spent time in big law, I went to a top law school, I know what all of the pressures are that go along with feeling like you need to perform in that kind of an environment I also know what it feels like to take a 50% pay cut to go work for the government and an even larger one to leave a law entirely, and so these are the experiences that I bring to the table. And so when I’m working with lawyers in particular, it really, there is a close connection, and they don’t have to explain to me what their life is like, they don’t have to explain to me why they can’t cut coffee out of their budget at those things come pretty natural to me, and it’s much easier for us to communicate and to find common ground when it comes to their money.

0:03:57.3 S1: Yeah, it sounds so scary when you think about leaving law or even jumping from a well-paying legal job to one that doesn’t pay so well, what are some of the stuff that you do to help people make that leap?

0:04:13.7 S2: The first thing that you need to do is really get your mind in the right place, I think that, especially in big law, which is really where I focus my attention because that was my experience, I have… I can help people with all kinds of money problems, I help people who are not lawyers, that being said, if I can help someone who’s going through exactly what I went through, that’s a much easier path for us to take together, and those are my favorite problems to deal with just because I’m so familiar with them. But when you’re practicing in Big Law, there’s all of these different forces that you feel out of your control, you probably don’t have control of your schedule, you feel like there are all these things that you need to spend money on, because otherwise you won’t be able to live your life, right? You have a dry cleaning, you need meal services, you need transportation, probably car service back and forth, there is… You maybe need to live in a particular type of neighborhood so that you can get to work on time, I mean, there’s all of these things that go along with a lifestyle of having a high stress, high demanding job, and yes, you are well compensated for it, but if you’re not watching where that compensation is going, it’s very easy to just get sucked into all of that, and it’s very hard to see how you could possibly survive and continue having a lifestyle that you really enjoy without that really big salary, without that comfort zone of being in an industry where salaries constantly go up, right, there aren’t many places where every year you get a raise and you know exactly what the rate is going to be, and it’s not immaterial.

0:05:50.2 S2: Right. So to go from that to something else is often a big mental leap that folks need to take, they need to get out of their own head, and they need to be able to see other paths from what success could look like. And when you’re at a firm, you don’t have time to look at anything else, so you only see one pathway and it’s up, and even if you don’t like the way that it looks… It feels like it’s the only thing that makes sense. So I have to help them see what other pathways are available and how they can get there, maybe even faster than they think… And that’s the work that we do together.

0:06:26.4 S1: Yeah, there’s definitely… I’ve had co-workers who… They had a dog walker, a nanny because they couldn’t get home within a reasonable time, they just had somebody basically living their life for them and it was just like… Yeah, they had somebody cooking for them, exactly, I think it was like the nanny or whatever, it’s just like, they’re not even really living your life, it’s really scary if your life is all work, because it actually is… I think sometimes people think that, we’re just making it up.

0:07:08.2 S2: It actually is a 24/7 job. I would be on investigations when I was on the defense side, where I was talking to people in Hong Kong, when I should have been sleeping… When I would go to Hong Kong to work, I would work through the Hong Kong day, and then I would work through the Eastern East Coast day. So it actually can be an all-consuming position, and so there are reasons why people set up their lifestyles in that way, and I think part of being in the personal finance space, so there are some gurus out there, there are some advisors out there that attach a lot of judgement to people who create lifestyles for themselves like that, because I lived it, and because I took advantage of many of those services myself just to get through the day, I don’t apply that to my clients and I help them not apply that to themselves. So that we can really think creatively about what do they want their lifestyle to look like, what parts of their life do they want to take back for themselves if they weren’t working all of the time, and sometimes it can help to have that conversation with somebody who has been through those exact moves for sure, because as you said, there’s a certain understanding where people that don’t understand, if you don’t hire all those people, then you don’t get to spend time with your family and your friends, and so hiring all those people enables you to have a little free time.

0:08:36.8 S1: So a little bit, yeah. Now, what about people who are in law school or about to start law school, and they wanna go into a career field that doesn’t pay very much, and there are law jobs that pay like $45,000, and yet they’re paying $200,000 to in law school. So what do you recommend for them to get set up correctly…

0:09:01.4 S2: Oh yes, I feel for all lawyers graduate with insane amount of debt, we don’t all go into big law, we don’t make hundreds of thousands of dollars out the gate. And I think there’s also a misconception that if you’re a lawyer, well, you must be rich, and if you’re having money problems, you’ve obviously created them for yourself because you are an attorney, you’re pulling in hundreds of thousands of dollars a year. What’s wrong with you that you haven’t been able to figure this out? And there’s an entire population of lawyers who just practice, and a lot of them are on the social service side, or they went straight into the government or they work at smaller firms or in smaller markets, the majority of lawyers don’t make big law money, so it’s really unfair that so much of the… All of the talk about How come lawyers can’t get their act together? A lot of them are struggling, just like regular people with a mortgage size debt that they graduated with, I always wanna get that out there, I do not subscribe to any of the misconceptions, and just because you’re a lawyer, well, then we have hundreds of thousand dollars to work with and we’re gonna figure out a solution for you, that being said, if you know that that’s the career that you want to go into, and that’s the path that you want to take, then we might need to re-jigger some things on the financial side to make sure that you can actually be successful.

0:10:31.5 S2: I think it’s when I graduated from Columbia back in 2004. So this is now so long ago, and back then, student loans were not what they are now, I have federal loans, but they’re actually private, so there… Those kinds of… That don’t qualify for any of the fancy forgiveness, they don’t qualify for any of the income-driven repayment plans, they don’t really have a lot of relief attached to them, they have a little bit, but not… What would you see now in the federal landscape, and I will say many of the clients that I work with that are newer attorneys primarily have federal student loans, and I think that there’s this misconception that it is just like every other kind of debt, and it needs to be treated just like every other kind of debt, it needs to be attacked immediately, you need to put your entire life on hold so that you can address it, and if you don’t do that, number one, you’re a horrible person, and number two, you will never ever have any financial stability in your life, and I don’t subscribe to either of those… Now, if you graduate from law school with $200,000 in private loan debt, we’re gonna have to have a very hard conversation about whether you’ve chosen the right career, because you will need money to pay that back if you wanna do anything else with your life, but if you’re in the camp that many of us are, where you’re graduating with federal student loan debt, there’s a lot of different things that we can do to make sure that we’re addressing a number of financial priorities over the course of your life and your career, and not just…

0:12:04.5 S2: You know, doing one thing for 10 years and then hoping that we have more time to hit everything else.

0:12:11.8 S1: Now, I know that some students can qualify for loan forgiveness, but it seems really complicated, and it seems like they’re being asked to kind of promise something like, I promise to work for so many years… But without getting a promise and return, is that an accurate feeling?

0:12:36.4 S2: I think some of this may be related to the way the Public Service Loan Forgiveness program was rolled out and the way that it’s been executed, there are horror stories of people who felt that they were in the program, but weren’t or people who have been making payments the way that they thought that they should, but they’ve been in the wrong payment plan for years, and none of that stuff counts, they were in the wrong kind of job, or they didn’t get their employer certified. A lot of this is a nightmare. I mean, if anyone that’s prepared for documentation and providing evidence, it’s us, right, we should have the best handle on being able to get loan forgiveness, that being said, when the program was rolled out in 2007, there was so much miscommunication about who it applied to, Who would be eligible, How you got into it, what you needed to do, that I think when you get to 2017, when you have the first people who might qualify for forgiveness coming and asking for it and being denied, there’s now this feeling in the industry.. that it was a baift and switch, it doesn’t work.

0:13:49.0 S2: I will say, I have anecdotal evidence. I don’t have the numbers, it’s very small, Percentage of people were only had it for a few years now, where people have even been in the program long enough to qualify for forgiveness, we do have anecdotal evidence that it has worked, but you have to follow all of the steps, and it is a lot of steps, and it’s not the only forgiveness program out there, there’s also the forgiveness that goes along with income-driven repayment plans, now those only apply to the federal loans, but that really does take into account someone’s financial circumstances. So if you are a lawyer who graduates with hundreds of thousands of dollars of student loan debt and you’re making $45,000 a year because you’ve chosen to provide services in that kind of a capacity, your monthly payment could be as low as zero, and after 20 to 25 years of your monthly payments, the balance of your loans will be forgiven, that’s in the master promissory note, however, you have to be in the right program, and that forgiven balance does have tax liability attached to it, so we plan for that too, but I don’t want people to walk away thinking, Well, the only way that I can deal with my student loans is if they’re federal and if I can find a way to get them forgiven, there are other pathways to financial stability than include paying off your student loans, whether they’re federal or private, it just needs to be part of an overall financial plan, and maybe doesn’t take two to three years, as most personal finance people will tell you you gotta

0:15:23.1 S2: Act it out as quickly as possible. Maybe it takes 10-15 years, but it’s gonna be part of your overall financial plan that also includes whatever your other financial goals are, so we’re gonna take advantage of whatever strategies we can to make sure that we are addressing that debt in a reasonable amount of time, for a reasonable amount of money, but we’re also not going to leave everything else off the table until… That’s all done.

0:15:50.3 S1: Yeah, I feel like lawyers, especially in the first several years of practice, are in this horrible situation where the sooner you start putting money into retirement, the more it’s going to grow and get compound interests and all these things that we want, but we don’t have any money because we have these student loans that technically most of us are told we can pay… We’re making good money, and it’s like, Well, okay, the good money debt to income ratio isn’t quite there, but technically, according to someone’s math, it’s all fine. It’s great, it’s like, okay, well, and then you add on, perhaps that you live in LA, San Francisco, New York, so there’s no cheap rent, much less save up for a down payment type of thing, so there’s just this whole mess, and then of course, as your income does go up a little bit, then you fall into the next mess, which is for tax purposes, you should buy a house, and again, you haven’t had time to save up that money and…

0:16:54.0 S1: Wait, what about that retirement… So it’s a big circular mess, and I think if you’ve practiced for longer and you have those raises and so forth, you kinda come out of it, I’m not gonna say great, but… Oh, okay, you kinda come out of it, but especially the first five, 10 years of practice, it’s all a mess, and like you said, it’s great to have somebody guiding you because you could have a million different goals. Are there certain mistakes that you tend to see that lawyers make?

0:17:28.1 S2: So I deal with a lot of different types of lawyers at different income levels, but something that you touched on, I think is a mistake that lawyers often make, they do not prioritize long-term savings over what is basically long-term debt repayment. And just like you pointed out, I always am trying to drum into my clients, you cannot get the time back in terms of your saving, if you waste… If you wait five years before you start really aggressively saving for your long-term goals, whether that’s retirement or being able to leave the law or being able to start your own business or be able to become an investor in some other type of area, you can’t get those five years back, and they’re gonna be the most important five years of your life, so if you can instead try to balance some of those priorities as stressful as it is, if you can try to balance some of them so that you are not ignoring any part of your financial picture, when you’re getting started, you’re going to reap huge benefits from that early action. I do not give investment advice, I don’t do Monte Carlo simulations for people, I can tell you what your investments will be worth, we know 40 years from now, but I do work with financial advisors because I don’t give investment advice.

0:18:47.2 S2: And I always like to have partners in the space, and I had one run a simulation for me, and we figured out that if first year attorneys maxed out their 401k, so just at the IRS limit, you can’t put anymore in there without penalty anyway, if you macero years, you would have over 2 million in retirement if you never contributed another time, and so that’s a powerful number to think about in terms of, Wow, maybe if I front-load some of this long-term saving activity, I won’t have to be saving so much for retirement when I’m closer to retirement, maybe I can be focusing on other goals at that point, and I think that that is lost in a lot of the conversation that both college graduates, but lawyers in particular get… Well, already starting late, we’re already three years later than everybody else, everyone else has had a job, they had benefits, they’ve had no matching contributions, You have to take care of all your finances all by yourself, nobody’s gonna be helping you with any of these things, and nobody feels bad if a lawyer doesn’t have a retirement when they retire, they think that you did something wrong over the course of your career, so a lot of the advice that I give to young or newer attorneys is make sure that you’re not just focusing in one area, and one of the big mistakes that I see is that’s exactly what they do, they’re either focusing just on their debt, or they’re just focusing on their lifestyle.

0:20:31.5 S2: Look, I graduated from law school with twins and I was a single mom, I had a lot of financial priorities pulling me in a bunch of different directions, the one really good thing that I did for myself was I invested in my long-term savings early, and I did it often. I am still paying down my student loan debt, but that is a conscious choice that I have made, I paid off all the private ones, they were horrible, and the interest rate for a time, but because I graduated in 2004, I was able to consolidate my federal loans at less than 2% interest, there was no reason for me to aggressively pay that down, I have 15 other financial priorities that I’m gonna focus on before I touch that, and you know what, if I die with that debt on me… It dies with me. Other debts don’t do that, they will follow my estate.

0:21:29.2 S2: I think there’s a little bit of misunderstanding and just lack of information about how all these different levers work, and so I think for newer attorneys, it really is important to understand what the entire landscape looks like and the trajectory of your career, you’re not always gonna be doing the same thing, and you’re always gonna make the same amount of money, and that can be really hard to envision on your own, and so sometimes having an extra set of eyes on those kinds of factors can help you see different paths that might have seem to close off to you before.

0:22:06.6 S1: So do you recommend that someone comes and gets financial advice or counseling right after they graduate, or as soon as they get their first job, or what’s kind of the sweet spot to make sure they’re starting off correctly.

0:22:19.1 S2: I think it really depends on where they are with their own financial literacy, I grew up in a home that never spoke about money, I was the first person in my house, in my family, really to have a graduate degree. My mom and I graduated college the same year, so if it gives you any indication of how shiny and new my experience was as compared to other folks in my family… I didn’t have a model, I didn’t have anyone to tell me, Oh, this is exactly what you should be doing. At these different points in your career. I think as soon as you are in a situation where you have consistent income, you want to make sure that you’re optimizing your salary, you want to make sure that you’re optimizing your financial situation this past year, we’ve seen a lot of tumbled in all kinds of economic situations, I would have loved more people to have come to me when the covid crisis hit, I was kind of shocked that people didn’t… And I think a lot of that just has to do with how ashamed we are about having money problems, how hard it is just stressful, right.

0:23:29.2 S2: If you have a reduction in income or if you lose your job, the idea of talking to somebody about your money at that point seems really sad and depressing and you don’t wanna talk about it, so a lot of folks come to me… As soon as they start making a little bit more money than they’re used to, and that is really a great time to come because you want to make sure you’re capturing whatever the potential excess is, you want to make sure that you’re taking full advantage of everything that you have going on… Of course, I help people who are struggling with money issues, it’s just often very hard to get them to come to me, but the ones who feel like they’re a little bit of fishing out of water, like, Oh, I feel like I’m an uncharted territory. Maybe I’ve never had a full-time job before. This is the first time that I have a salary as opposed to being an hourly worker, I worked all through college, and I know what it’s like to have that as your income, it’s a very different experience when you know what your paycheck is gonna be every other week or every month, or whatever it is.

0:24:33.6 S2: And sometimes do you think that’ll just all kind of take care of itself and it won’t it be good idea to come in and make sure you have the systems in place to completely take full advantage of that new opportunity that might feel a little unfamiliar to you.

0:24:48.5 S1: I can see where a lot of the new attorneys, and especially if maybe they’ve been practicing for a year, so they have been maybe making a lot of big purchases or going out a lot, ’cause they’re rewarding themselves for all their hard work, are a little afraid to then take a step back and say, Maybe I should seek some advice so I can actually do things better for my long-term plan, and I know you said you talk to people who are not always in the best financial situation, so… Do you recommend then that people, if they have… Like I said, when your associates who have made big money purchases that maybe they should know that they come talk to you to try to get on the right path.

0:25:32.9 S2: Oh, good. Is you just describe many of my Clients, I definitely… You would not believe how many people sign up to work with me, and in between the time that we have our initial consult and the time that we have our first session, many financial decisions are made, those decisions often involved buying a new car, signing up for a new service or whatever. Like it’s kind of like right before you go on a diet, you go on a little bit of a binge beforehand and… And the idea is, Well, I can take care of this, it’s gonna be fine, and so they come in and… Right between our initial consult when I had a kind of a picture of their finances, and when we sit down for our first session, we have some conversation on what happened over the past three weeks… Tell me about that, tell me about this. What does that feel like? Okay, did you enjoy… How do you feel? Do you have any buyers remorse now? Do you want to continue? Is that really important to you? Do you enjoy it? ’cause if it brings you you a lot of joy, then is a great purchase for you,

0:26:32.8 S2: Now we will fit it into your financial plan… Yes, I promise, we will figure out a way to still make it work. I definitely work with folks who have variable income law firm owners or other self-employed individuals, and it really is a different mindset that you have to have… You still want systems in place, and I think coming to someone, if you feel like you’re a little bit out of control and that you don’t really have a good sense of, number one, what’s going on with your money or that you could like to be doing something else with your money than you can tell is happening already, that is absolutely a great time to come meet with someone, it’s gonna be hard to bring yourself to do it, but the pay-off is going to be so much relief and financially, you’ll be in a better position to deal with all of those ups and downs, so I could tell you, Jolene, there’s never a bad time to reach out to a financial counselor… Right, I have clients who are thinking of going to law school and their whole struggle is, Can I afford it, what’s it gonna do to my family, am I gonna be the law student…

0:27:40.3 S2: and we talk about what different scenarios will look like, how can you afford this in a way that makes sense for your family and the financial goals you’ve already set out for yourself, what can we do creatively, I will say this, I get a lot of questions, or What should law students be doing? Honestly, I don’t know, it’s hard. You’re in too, in the hardest type of school that exists, and you know people… I see suggestions, we’ll just get a second job and I’m just like, what…

0:28:15.4 S2: During what hours? So look, I think for law students, summer is your time to make a huge difference in everything that you’re doing, right, you will hopefully not be in school unless you have already chosen to be in a part-time program, at which point you are probably already working in some capacity, so you’ve already made a good financial decision to be cash flowing your study, right, that if you’ve already made the decision to join a full time program… I’m gonna be honest, I think that’s really hard to handle financially, if you don’t have a plan beforehand, either reserves that you have built up because you worked and you saved, and so you’ve been a pretty good position going in there, and then taking advantage of those summers reducing your expenses however you can while you’re a student, if it’s possible for you to go to a school that’s close to home and you get to keep your living expenses down, that’s gonna cut your basic law school expenses in half. Tuition is one thing, but room and board is a nightmare. And if you don’t have a job, which you probably don’t, if you’re in a full-time program, you’re taking out loans to pay for your meals, to pay for your apartment.

0:29:25.6 S2: And they’re not inexpensive. I went to Columbia, I was in New York, ’cause there were no inexpensive apartments, and then I had kids, it was also not inexpensive for me.

but I did have a summer associate shift and I probably could have used that money better, i wasn’t a financial counselor back then, I didn’t understand all of this, they just are all the monies, right? There’s this sometimes this assumption that even law students should be able to do be doing way better than they are, and there’s all these things that you could be doing with what time and what energy… I don’t know. Maybe you’re a super star law student. Good on you. That’s probably not who I’m talking to. So don’t beat yourself up too much if you’re trying to get through your program, especially if it’s not being met with you, also is really, really hard and requires a lot of mental energy, so if you’re not able to hold it on a part-time… A full-time job while you’re working… While you’re going to law school, I’m not going to dock you for that, but we’re gonna have to figure out how to deal with that when you get out, and it might make life after law school a little more difficult than it would have been otherwise, it doesn’t mean it’s impossible, it just means you have to make some different financial decisions when you finally are able to take on some more responsibility, you are able better your financial situation a little more…

0:30:53.7 S1: Yeah, I think that law students don’t realize that, first of all, everyone goes in with different advice, so some are just told, Oh, just take out the loans, it will be fine, others just… Either through advice or intuitively are like, I am only going if I can go for free, so there’s this whole wide range of how much debt everyone has… Then there’s the schools where some have a straight C curve and some have a B curve, so yeah, if you’re gonna work on a C-curve, you’re risking your grades and potentially being kicked out, and I had a school that kicked people out even after second year, so you are never safe. Yeah, we all graduate with different factors, different reasons we did different things differently and different amounts of debt, and again, not all our fault, we got bad advice, or we went to a school where the GPA was so low that we really couldn’t risk spending the time to work or just our own brain capacity, right, it was just so hard for us that we couldn’t work.

0:31:54.4 S2: I love your tip about making sure that you understand the law school situation that you were getting into, and when I meet with somebody who is considering going to law school… Those are exactly some of the questions that we need to go over it. Can you do a part-time program is it even offered… Can you handle doing a part time program and working full time, can you work full-time while you’re at a part time program? I know many lawyers or many law students who are able to do that because they’re wonderful and they have super brains and they have excellent time management skills, and maybe they have children at home or maybe they don’t… You really have to look at your situation and be realistic and honest, and also understand what you want to get out of it, if you don’t want to have a law school experience where you are on the edge of academic probation the entire time, then you might want to try to set yourself up a little bit more for success, in order to do that, you have to know yourself and you have to know your program… In order to make that decision, you know, I had no pre-law advising when I was in college. Basically, I made my decision of where I was gonna go to law school, which one is the top one on US News and World Report. Okay, that’s what I’m going. Okay, what was the most expensive Oh my goodness, I could have gone a couple of slots down for $40,000 less…

0:33:21.1 S1: I’m with you, I did the same thing. I just, I lived at home, so I did save that money, but yeah, but it was still a very expensive school and they didn’t offer me money, and I just was like… I was told just take out the loans, it will be fine, and so I just was like, Okay, but I’m glad that people are coming to you before law school, I tried to emphasize to people how important is to get as much guidance as you can and concrete guidance not just Let’s search the internet, but like actually talking to people before they go to law school so that they can hear different experiences, and again, if they got, let’s say bad advice from one person, if they’re talking to a lot of people, if they’re actually talking to someone who’s in a position that does this type of thing and it gives financial advice or even just law school advice, that they actually get on a better path than they would have been otherwise.

0:34:13.7 S2: Oh yeah, no, I do think that it’s… Now that there are so many alternative pathways to law school, number one, it doesn’t have to be straight through college, that was my path, but I also went to school with people who had come from companies at Columbia actually had on average, a much older law student than a lot of other universities. And so we really did have a nice diversity of life experience at the law school itself, and you could see this wasn’t always the first career for people, also people came with scholarships, which I didn’t understand was a thing, and if someone had been there to kind of point all of these things out in a way that made sense for me. It… We can all do research on the internet, and I can find 5000 different scholarships right now, I have no idea which ones I might be eligible for, or which ones are more likely for me to be awarded them. And no, I don’t want to mislead anyone. I am not a pre-law expert. This is not my area. Right. I work with practicing lawyers who are trying to do something else with their life, whether it’s in the law or out of it, that’s really my sweet spot, but because I’m in this space, folks who are thinking about going to law school, see me and they say, Oh, well, maybe Jessica could help me think through that decision, and of course I can because it’s a career transition just like any other…

0:35:40.8 S2: Right, there’s all of these different moving pieces, they’re all affected by the other, but I also have pre-law experts in my network, Jolene is one of them, what I need to send people… She’s gonna help you plug all of these holes the right that we talked about your overall financial picture, but she’s gonna help you make the plan for exactly how you’re gonna make this work, we just gonna connect you with other resources that are not part of my wheel house, and I think that often times, sometimes people look for an all-in-one, and with these kinds of decisions, if someone tells you that the expert at all of it, they’re lying, because none of us could be an expert in all of it, and you kinda have to figure out where your interest lies, I never had any scholarship, so I’m not super interested in learning about all the opportunities I missed out on, but being able to work with someone like you or somebody else who helps people really maneuver that first year and plan those years out, I think it’s an invaluable service and we all have roles to play in the decisions that perspective and practicing attorneys make over the course of their career.

0:37:02.7 S1: Yeah, I think that you said something really important there, which is, you know, there’s a phrase for children, it takes a village, right? Everyone needs to help out that you can’t do it alone. I think it’s the same thing when you go into law school and… Yeah, and I do the same thing, I have a network of people. A financial advice is always great, but having someone counsel you that has been through law, who understands law, I think a lot of people also don’t realize, aside from long-term planning, I don’t think people… They don’t go to the law school to plan to leave law. So it’s good to know that people like you exist, so one, they can make a good final plan, but two, they can come back when suddenly they realize, this doesn’t feel right. What are my other options? What should I be doing…

0:38:02.6 S2: Yeah, I run into a lot of people who know that they don’t necessarily want to be doing the kind of law that they do when they graduate. Yeah, so maybe they graduate and they go to a firm because they wanna get that experience under their belt, and they wanna be able to transition into government or non-profit work or advocacy work, and knowing that that is in your future can feel a little insurmountable if you don’t know how to get there. Right, and to just think, Oh, so in three years, I’m going to leave. What do I need to be doing to get ready for that? So I also have clients who aren’t actually struggling in their job because they know they wanna leave, and they just wanna make sure that they meet the most of their time while they’re there, and that really does require some strategizing, because if you’re gonna be somewhere for 10 years, that’s very different than if you’re only gonna be there for three years, we might do different things. And so that is also part of… My clientele comes to me either because they are super stressed out and they really, really wanna get out, and they think that they can’t do it, and that’s just adding more stress to even trying to consider a career transition, or just folks who…

0:39:13.9 S2: Oh, they know they wanna do it, they don’t need to do it right away, but they know it’s coming, and they would like to be prepared, and what do lawyers like more than anything else, being prepared is my biggest tip for pre-law students is talk to as many lawyers as you can… So you understand what the practice is like, so you understand the things that are important to pay attention to both while you’re in school and soon after you graduate, and also to just get a sense of what lawyers do day-to-day to make sure that’s really something that you’re going to be interested in. I think the law shows up in television in a way that is completely unrealistic when it comes to what you actually do on a day-to-day basis, at least it was for me as a junior associate in a large law firm, it eventually got better, but nobody told me that I would be… We’re giving a lot of documents and basically just managing egos up and down the chain, so I think talking to actual lawyers about their practice is so important, and if you are a practicing attorney and you’re not sure whether you want to remain one, talk to people who are not lawyers? Get some perspective on what life feels like outside of the law, because as wonderful and amazing and bright and engaging as lawyers are and we are, we all have blinders on, and many of us cannot see beyond our own profession.

0:40:37.7 S2: So talk to people who are outside of the profession, see what’s important to them, how they structure their life, what kinds of things they value, and if those are things that you value, you might be happier outside, those are my two tips…

0:40:52.0 S1: Oh my gosh, I love this. I wish I had heard that before I went to law school, or honestly even just as a lawyer. Those are great tips. Thank you so much, Jessica, I really appreciate your time today.

Before we get into my top takeaways, a quick word from our sponsor, Juno. Now, if you need to take out student loans, check in with Juno first, Juno can often offer law students one to 2% less in interest rates over government loans, and not only with no cost to the student, but often cash back as well. Visit joinjuno.com/p/legalLearningCenter for more information.

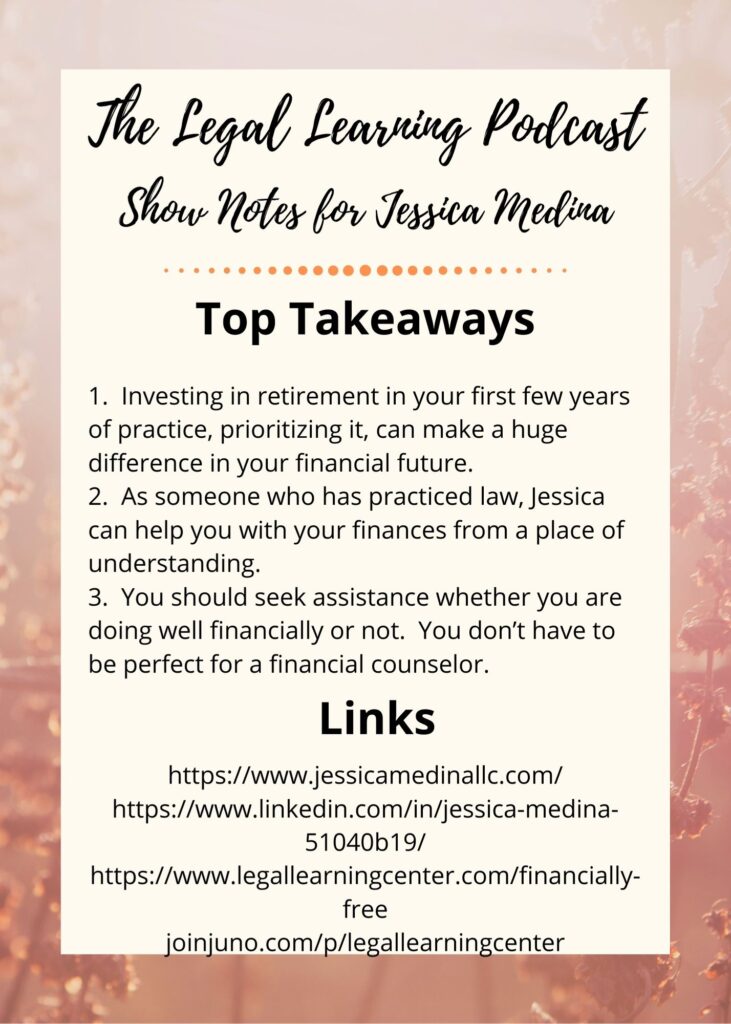

Okay, so my top takeaways from this chat with Jessica, Number one, investing in your retirement early in your career, prioritizing it can make a huge difference in your financial future. Number two, as someone who has practiced law, Jessica can help you with your finances from a place of true understanding, number three, you should seek assistance whether you are doing financially well or not, we are perceived as successful by others, but don’t let that stop you from telling Jessica or someone like Jessica about your problems. 0:42:16.6 S1: You don’t have to be perfect to go to a financial counselor, don’t let others perception of your success stop you from sharing any problems you’re having. Okay, that’s it for this episode. All the links and tips and so forth will be available in the show notes, a full transcript is available at LegalLearningCenter.com/Jessica, and if you learn something today, please like share, subscribe, comment, so that this show is more visible to those who may need it… Thanks.

If you enjoyed this episode, be sure to listen to our entire Law & Finance Series:

Episode 4 – When to Seek a Financial Coach